Regularly reviewing and updating these bases ensures that cost allocation remains fair and reflective of current realities. For example, if a company undergoes a significant restructuring, the allocation of HR services might need to be adjusted to account for changes in employee distribution across departments. This dynamic approach helps maintain the relevance and accuracy of cost allocation over time. Discuss the advantages and disadvantages of the NRV less an average gross profit method of allocating joint costs. The term “joint products” refers to a group of products that are produced simultaneously by a common process.

AccountingTools

The objective of this approach is to create equal gross profit percentages for all joint products. The average, or overall profit margin is the relevant measurement for the decision to produce or discontinue the joint process, i.e., produce allor none. However, critics of this method argue that since all joint products are not equally profitable, the joint cost allocation method should not imply thatthey are5. A counter argument is that all joint cost allocations arearbitrary in that the true profitability of individual products is indeterminable. Therefore, the joint cost allocations should not imply that trueprofitability has been obtained.

Lattice allocations: A better way to do cost allocations

For example, situations arise where a user’s budgeted and actual consumption of a serviceare the same, but the actual service cost allocation to the user is greater than the budgeted allocation. The direct allocation method is the simplest and most straightforward approach. It involves assigning costs directly to the departments or services that incur them. This method is particularly effective in organizations where the relationship between costs and departments is clear and direct.

Impact of Technology on Allocation Methods

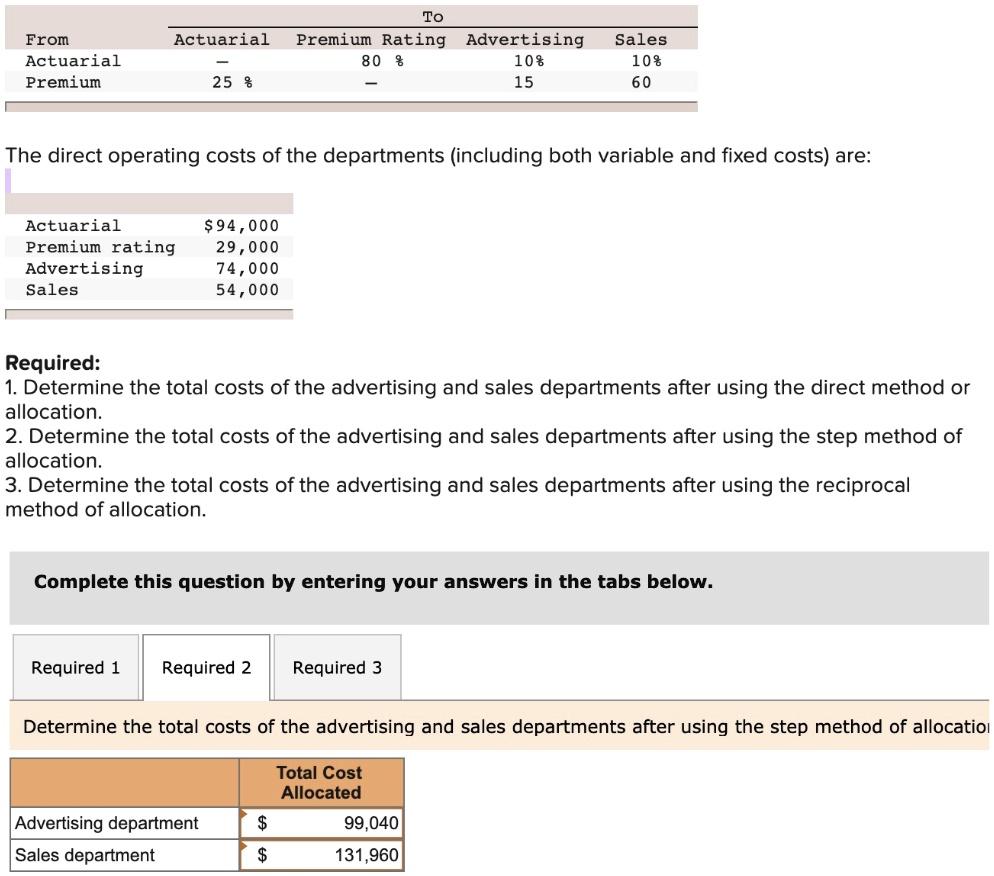

What does the term traditional two stage allocation process mean? (See Exhibit 6-1 and See the Baggaley & Maskell summary for an illustration of support functions within a manufacturing environment). Each of these equations includes two unknowns, thus determining S1 and S2 requires solving the equations simultaneously. Although simultaneous equations are notnormally solved by hand in practice, one method is presented in Exhibit 6-6 to illustrate the concept. Observe that the denominator for the proportion of service provided from S1 to S2 is 900, not 950. This is because the 50 KWH’s of self service are ignored in thestep-down method.

Products

The notes to the table show how the overhead rates werecalculated in each case. To show how a single plant wide overhead rate can distort product costs, assume that the firm in Example 6-1 produces two products, X1 and X2. Recall from the example that thereare two producing departments, Cutting and Assembly. Although each product passes through both departments, the products do not consume the departmentresources in the same proportions. As indicated in Exhibit 6-14, X1 requires a larger proportion of cutting time, while X2 requires a larger proportion ofassembly time. The various functional areas within a manufacturing facility are usually separated into two types of departments.

The Company

- Understanding the different methods of cost allocation is fundamental for any organization seeking to manage its finances effectively.

- She holds an MBA from the University of Illinois at Springfield.

- When are activity based overhead rates needed to provide accurate product costs?

Using the data above, fully reciprocated human resources costs equal $150,000 + (fully reciprocated custodial services costs x 10 percent). Fully reciprocated custodial services costs equal $70,000 + (fully reciprocated human resources costs x 13 percent). Using this information, FRHRC and FRCSC can be calculated algebraically.

Clear communication about how and why costs are allocated can mitigate potential conflicts and foster a culture of trust. Regularly scheduled meetings and detailed reports can help departments understand their cost responsibilities and the rationale behind them. For example, a quarterly review meeting where financial managers explain the allocation bases and any adjustments can demystify the process and encourage collaborative problem-solving. One of the primary benefits of ABC is its ability to highlight inefficiencies and areas for improvement.

D’s overheads would be similarly reapportioned on the basis of 75/95 and 20/95. Which type of overhead rates, plant wide, departmental or ABC are determined using a two stage cost allocation process? When are activity based overhead rates needed to provide accurate product costs? In the sections above, several comments were made in reference to the decision of whether to sell raw chicken or fried chicken. Following this decision rule, the joint costs arenot relevant because they will not be different regardless of the decision to sell at the split-off point or to process the products beyond this point.

To simplify the illustration, we will use the direct method for service cost allocations and ignore maintenance costs. Budgeted power cost allocations based on the dual rateconcept are presented in Exhibit 6-10. Fixed costs are allocated in proportion to the original capacity available to the user departments. Variable costs areallocated using a rate of $100 per kilowatt hour. The purposes of cost allocations are closely related to the purposes of information systems outlined in Chapter 2 (See Exhibit 2-4 for a review).

The reciprocal service to C is ignored as, by now, it is not material. However, if we choose to fully reflect the reciprocal services between C and D, one of two methods are possible – the repeated distribution approach or the algebraic approach. Both are methods of solving a simultaneous equation and should give the same result. In the exam, the edit and manage your invoice template fillable pdf file online examiner will indicate that he wants you to use one or either of these methods by asking for a method that ‘fully reflects the reciprocal services involved’. Practically in the FMA/MA exam, where this topic would be examined by two-mark questions, the focus will be on the algebraic approach as repeated distribution would be too time consuming.