The company has calculated the following usage of X and Y’s services. If you remember your school maths, you will note that the equations for C and D are simultaneous – ie C is a function of D, and D is a function of C. Various approaches are possible to solve simultaneous equations but substitution is probably quickest. Firstly, we can setup the overhead re-apportionment process as a set of equations. Determine the difference in the total operating cost if electricity were purchased externally and indicate whether the company should make or buy electricity.

Related AccountingTools Courses

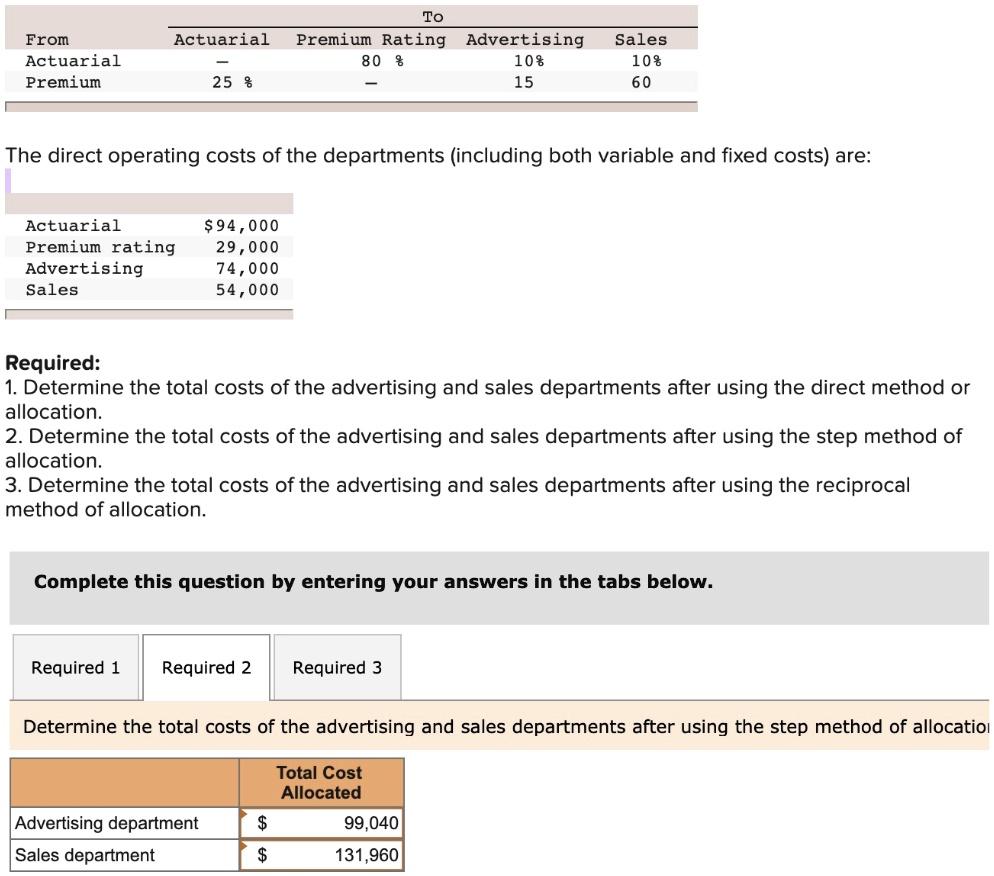

System designers must remember that cost allocations affect performanceevaluations, which in turn affect performance. As indicated in Chapter 1, performance evaluation systems are interactive in that they simultaneouslymeasure and influence the behavior of the participants within the system. Now that the fully reciprocated costs of each service department have been calculated, the allocation for each production department can be completed.

Re-apportionment of service cost centre costs

Assembly has 10 employees, accounting for 67 percent of the employees used to allocate costs. Painting has three employees, accounting for 20 percent of the employees used to allocate costs. Custodial services has two employees accounting, for 13 percent of the employees used to allocate costs. Reciprocal costs refer to costs that are shared or jointly incurred by multiple departments, services, or activities within an organization. These costs cannot be directly assigned to a single department or cost center, as they benefit or are consumed by more than one area of the organization. A company’s overheads have been allocated and apportioned to its five cost centres as shown below.

AccountingTools

- The values added beyond the split-off point are $280,000 for productW and $160,000 for product D.

- Use the direct method and make the following calculations for the Purchasing and Receiving cost allocations to the Cooking and Canning Departments.

- Since this is not likely to be an accurate assumption concerning the values added by the separate joint and after split-off processes, the NRVestimates of values at the split-off point are likely to be misstated.

- After the simultaneous equations have been solved, the allocations to the producing departments are easily determined by hand as follows.

The underlying concepts of cost allocations relate to the purposes of assigning costs to cost objects as well as the principles, or supporting logic for the cost allocation methods chosen. Fully reciprocated human resources costs to be allocated to production departments, as calculated above, equal $159,068. The assembly department allocation equals 67 percent of $159,068, which is $106,575. The painting department allocation equals 20 percent of $159,068, which is $31,814. Total maintenance cost can be calculated as$8,000 department cost + $1,429 (7,145 x 20%) allocated fromadministration for a total of $9,429.

However, thismethod is more involved because it requires the solution to simultaneous equations. Although issues concerning the equitableness of various types of taxes are outside the scope of a cost accounting course, similar controversial issues arise with regard to costallocations within organizations. Generally, the allocation method should reflect the purpose of the allocation. For example, for the purposes related toproduct costing, (e.g., external reporting, planning and monitoring, pricing) costs are typically allocated (or traced) to products based on the “causeand effect” logic. Using the methods described in Chapter 3 (e.g., regression and correlation analysis) the system designer might attempt to definea relationship between the cost and the cost drivers objectively. For example, for performance evaluation and motivation purposes, the “fairness and equity” logic is sometimes moreappropriate for common administrative and facility related costs.

These include producing departments and service departments.Producing departments convert raw, or direct materials into finished products. Service departments provide support services to the other departments in theplant. Some examples of service departments include purchasing, receiving and storage, engineering, power, maintenance, packing, shipping, inventory control,inspection and quality control. Service department costs must be assigned (applied, allocated, or traced) to the inventory for product costing purposes.

Use the direct method and make the following calculations for the Purchasing and Receiving cost allocations to the Cooking and Canning Departments. Allocate the budgeted costs using account management software and account management tools either a single or dual rate method. Allocate the actual costs using a single rate based on the actual costs. Allocate the actual costs using the single budgeted rate method.

To solve this dilemma some companies value the inventory at finalsales value, less after split-off cost, i.e., NRV. From the performance evaluation and behavioral perspectives, the amount of fixed service cost allocated to a user is more meaningful if it is not influenced by variations inthe short term consumption levels of other users. The dual rate method simply provides a way to implement this idea which reduces the inevitable behavioralconflicts created by the cost allocation process. Another advantage of the dual rate method is that spending variances for both fixed and variable costs can becalculated when the actual service costs differ from budgeted costs. A disadvantage of using the dual rate method is that idle capacity costs for theservice departments are allocated to the user departments.

These costs, which are included in indirect overhead, must be allocated to the departments that use those services. Examples of service departments are human resources, accounting, information technology and custodial services. Given advances in computing power, the reciprocal method would seem to be accessible to many companies that are not using it. Presumably, these companies believe that the benefits obtained from more accurate service department cost allocations do not justify the costs required to implement the reciprocal method. In fact, many companies do not allocate service department costs at all, either because they do not think these allocations are beneficial, or because they do not believe that the benefits justify the costs.

The reciprocal method is the most accurate of the three methods for allocating service department costs, because it recognizes reciprocal services among service departments. It is also the most complicated method, because it requires solving a set of simultaneous linear equations. The Reciprocal Method is the most accurate and comprehensive of the service department cost allocation methods, but it’s also the most complex. The basic premise is to account for the interaction between service departments and not simply ignore the services they provide to each other.